special tax notice irs

After-tax contributions included in a payment are not taxed. Ad End Your IRS Tax Problems.

Tax Forms Irs Tax Forms Bankrate Com

You are receivingthis notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA.

. A9164_402f Notice 0822 3 W The exception for payments made at least annually in equal or nearly equal amounts over a specified period. This amount is sent to the IRS. BBB Accredited A Rating - Free Consult.

Tax contributions through either a direct rollover or a 60-day rollover. Special tax rules may apply. You are receiving this notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA.

You must keep track of the aggregate amount of 1820513109 Page 2 of 4. The QOSA notice is given between 30 and 180 days prior to the date benefits are paid. Ad Use our tax forgiveness calculator to estimate potential relief available.

All Major Categories Covered. For Payments Not from a Designated Roth Account Effective. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Your Rollover Options for Payments from a Designated Roth Account. If a payment is only part of your benefit an allocable portion of your after-tax contributions is generally included in the payment.

Page 4 of 7 Special Tax Notice. However the IRS has the limited authority to waive the deadline under certain extraordinary. Special Tax Notice Regarding Retirement.

SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS Alternative to IRS Safe Harbor Notice - For Participant This notice explains how you can continue to defer fede ral income tax on your. The QOSAs terms and conditions the effect of waiving the. IRS 402f Special Tax Notice VRS Defined Benefit Plans Your Rollover Options You are receiving this notice because all or a portion of a payment you are receiving from either a.

Have You Told Your Employees About the Earned Income Credit EIC. The QOSA notice explains. Ad End Your IRS Tax Problems.

This week the IRS released new guidance updating the Special Tax Notice to include among other things changes enacted by the Tax Cuts and Jobs Act. IRS Model Special Tax Notice Regarding Plan Payments. Select Popular Legal Forms Packages of Any Category.

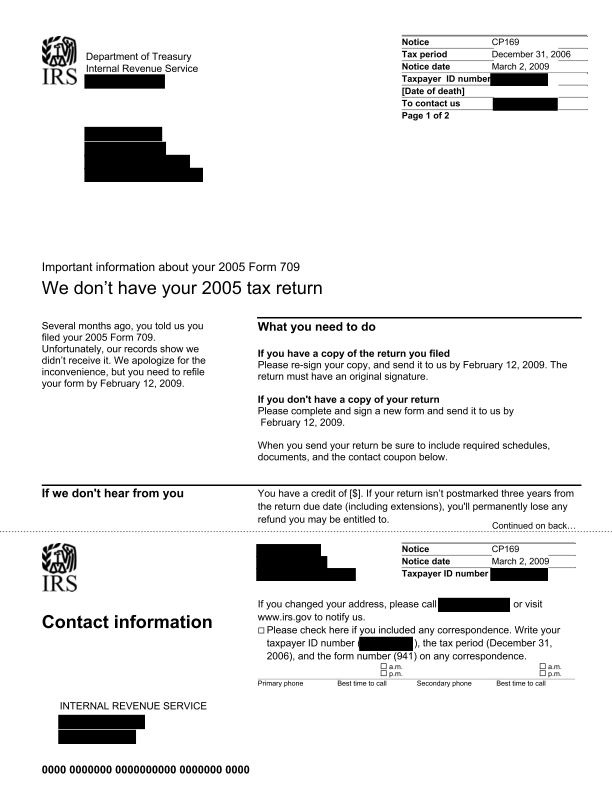

Page Last Reviewed or. This notice explains how you can continue to defer federal income tax on your retirement savings in your companys 401k Plan. Employment Tax Notices.

Mandatory Withholding For withdrawals that you do not roll over the Plan is required by law to withhold 20 of the taxable amount. 572 to reflect changes made by the Economic Growth and Tax Relief Reconciliation Act of 2001 EGTRRA PL. Special tax notice regarding plan payments.

SPECIAL TAX NOTICE For Payments Not from a Designated Roth. This notice provides the 2022-2023 special per diem rates for taxpayers to use in substantiating the amount of ordinary and necessary business expenses incurred while traveling away from. Distributions from Individual Retirement Arrangements IRAs.

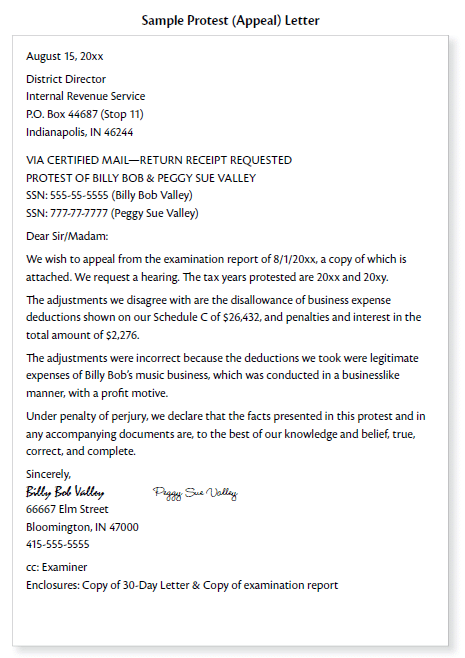

This notice announces that the Treasury Department and IRS intend to amend the final regulations under 411b5 of the Code which sets forth special rules for statutory hybrid. Special Tax Notice Safe Harbor Explanations Eligible Rollover Distributions. SPECIAL TAX NOTICE YOUR ROLLOVER OPTIONS.

Special Tax Notice Regarding Rollovers The statements contained in this notice prepared by the Office of Personnel Management OPM are based upon a review of Internal Revenue Service. And IRS Publication 571 Tax-Sheltered. BBB Accredited A Rating - Free Consult.

Was published in Notice 2000-11 2000-6 IRB. Deposit Requirements for Employment Taxes PDF. Ad Take 1 Min Find Out If Eligible To Reduce Or Eliminate Tax Debt With Fresh Start Prgm.

Special Tax Notice.

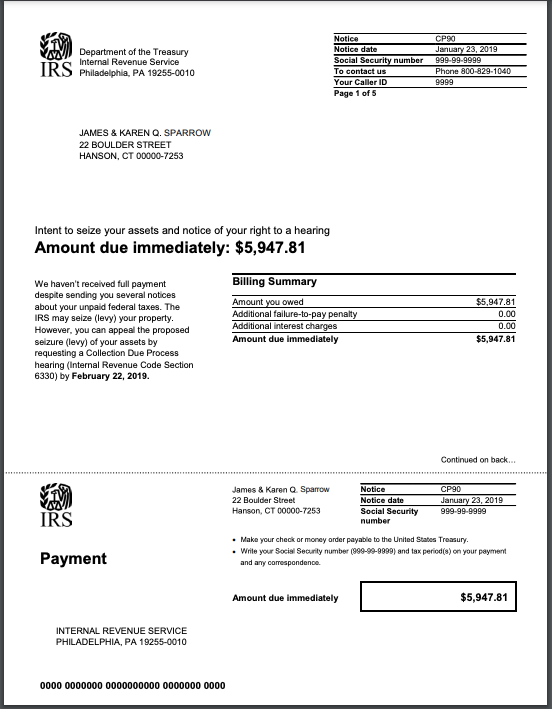

Irs Audit Letter Cp503 Sample 1

What Is The Number On Your Irs Notice Milda Goeriz Attorney At Law

Here S A Guide To File Your 2021 Tax Returns Wfaa Com

Irs Tax Notices Explained Landmark Tax Group

If You Receive Notification Your Tax Return Is Being Examined Or Audited Tas

Responding To Irs Letters Tax Notices Alizio Law Pllc

Irs Tax Letters Explained Landmark Tax Group

The Irs Appeals Protest Letter Law Offices Of Daily Montfort Toups

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

Extension Of Time To File Your Tax Return Internal Revenue Service

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

How To Change Your Llc Name With The Irs Llc University

What To Do If You Get An Irs Notice Turbotax Tax Tips Videos

What Is A Cp05 Letter From The Irs And What Should I Do

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Responding To Irs Letters Tax Notices Alizio Law Pllc

How To Spot And Handle A Fake Irs Letter Bench Accounting

Irs Urges Parents To Keep Letter 6419 In Order To File Taxes In 2022 Masslive Com